DEF BLOG :

You can read articles here. Find news articles about innovation and coding here. We have many good articles to read.

2025-05-13 03:40:24

Although C++ is the primary language commonly used for pricing options, the team decided to use Python entirely for learning purposes. This not only provides an opportunity for the team to practice th

2025-05-12 08:31:36

In the previous article, a set of linear equations was arranged in the form of a tridiagonal matrix equation. Solving this equation allows for the cal

2025-05-12 03:48:15

In the previous tutorial on Finite Difference Methods it was shown that the explicit method of numerically solving the heat equation lead to an extrem

2025-05-09 08:28:08

In Part 1 of the series on Finite Difference Methods, it was shown that continuous derivatives could be approximated and applied to a discrete domain.

2025-05-09 03:40:39

This is the first in a multi-part tutorial series on using Finite Difference Methods (FDM) to numerically solve parabolic partial differential equatio

2025-05-08 07:15:15

If you have just completed your PhD or are nearing completion and are looking for opportunities in the Quant (Quantitative Analyst) or Financial Engin

2025-05-08 03:26:52

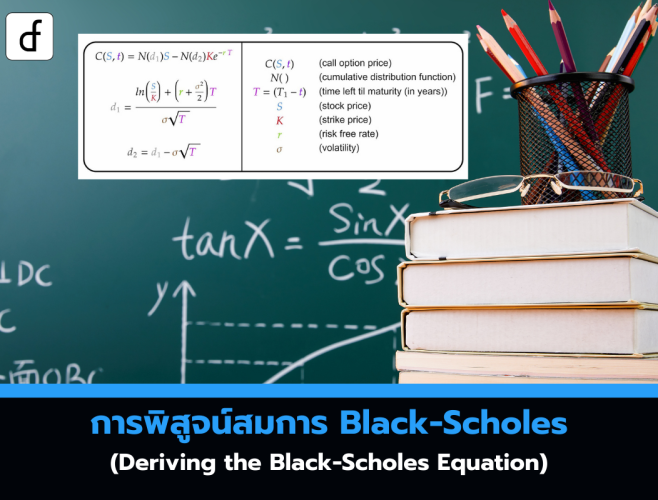

Now that we have derived Itos Lemma, we are in a position to derive the Black-Scholes equation. Suppose we wish to price a vanilla European contingent

2025-05-06 09:34:54

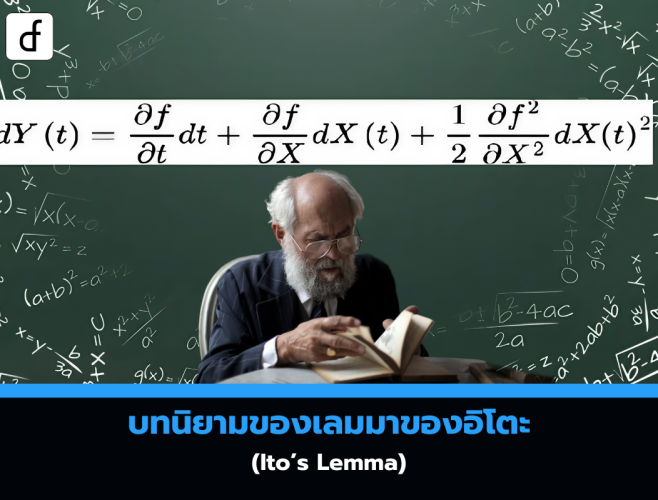

Itos Lemma is a fundamental rule in stochastic calculus (Ito Calculus) that extends the chain rule from regular calculus to be applicable to stochasti

2025-05-06 07:12:00

Geometric Brownian Motion (GBM) is a fundamental model widely used to describe the behavior of asset prices over time. This model guarantees that pric

2025-05-06 03:42:09

Previously, we introduced Brownian Motion and the Wiener Process as the foundation for modeling asset price paths.However, standard Brownian Motion ha

2025-05-05 09:39:07

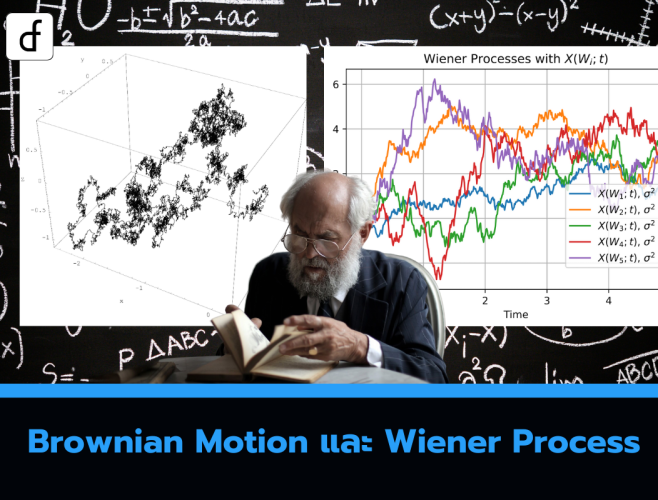

In a previous article on the website, we introduced stochastic calculus in the context of its role in quantitative finance. The properties of Markov a

2025-05-05 06:50:21

Currently, Python has become the main language in the field of quantitative finance. It is widely used in both investment banks and quantitative hedge

Recent post

2025-01-10 10:12:01

2024-05-31 03:06:49

2024-05-28 03:09:25

Tagscloud

Other interesting articles

There are many other interesting articles, try selecting them from below.

2024-08-06 04:19:32

2023-12-13 03:31:03

2025-02-19 10:22:00

2024-05-16 05:13:17

2024-04-25 09:36:08

2024-03-11 02:51:39

2024-10-10 10:45:27

2025-02-10 03:09:32