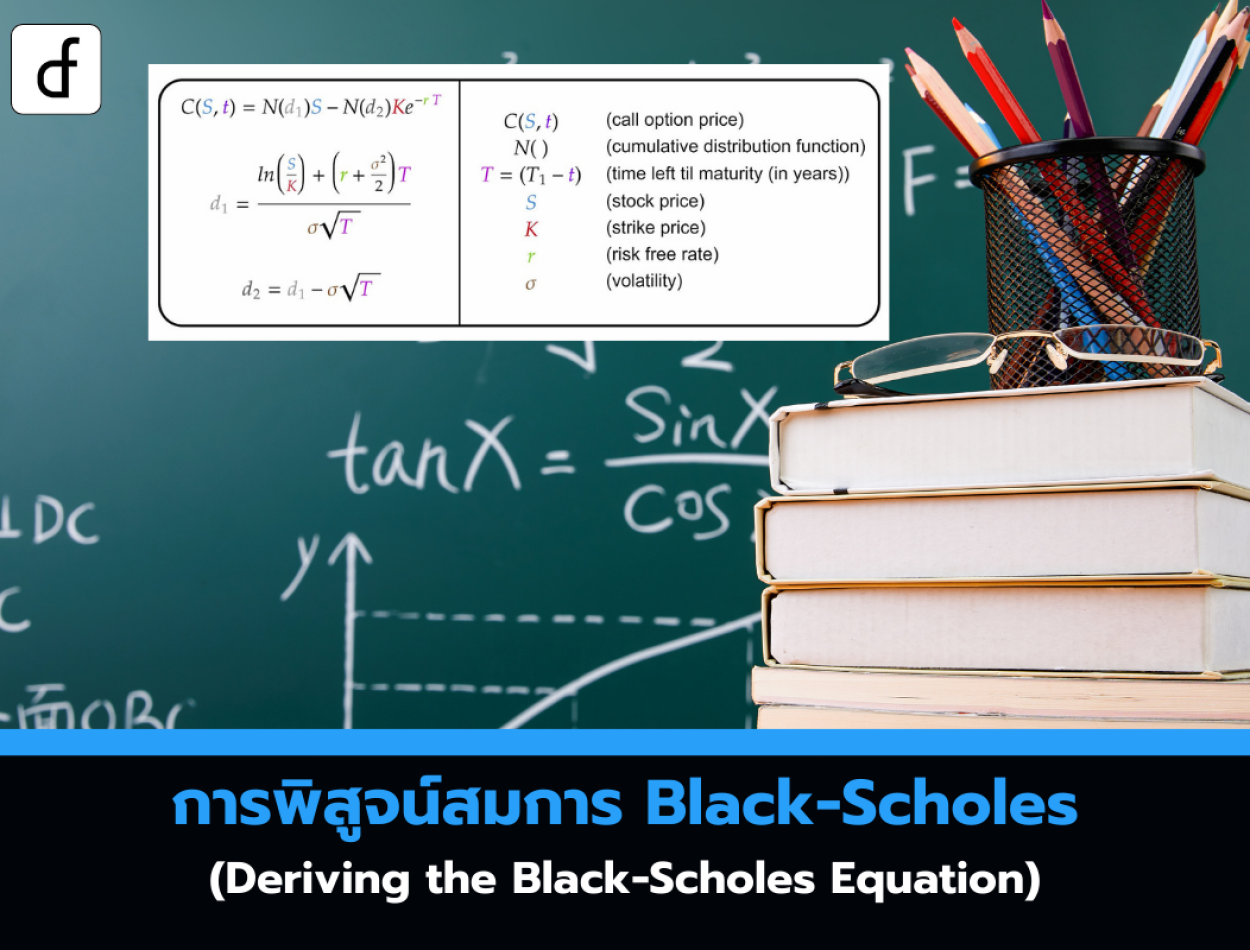

Deriving the Black-Scholes Equation

2025-05-08 03:26:52

Now that we have derived Ito's Lemma, we are in a position to derive the Black-Scholes equation.

Suppose we wish to price a vanilla European contingent claim C, on a time-varying asset S, which is set to mature at T. We shall assume that S follows a geometric Brownian motion with mean growth rate of

Since our option price, C, is a function of time t and the price of the asset S, we will use the notation C = C(S,t) to represent the price of the option. Note that we are assuming at this stage that C exists and is well-defined. We will later show this to be a justified claim.

The first step is to utilise Ito's Lemma on the function C(S,t) to give us an SDE:

Our asset price is modelled by a geometric Brownian motion, the expression for which is recalled here. Note that

We can substitute this expression into Ito's Lemma to obtain:

The thrust of our derivation argument will essentially be to say that a fully hedged portfolio, with all risk eliminated, will grow at the risk-free rate. Thus, we need to determine how our portfolio changes over time. Specifically, we are interested in the infinitesimal change of a mixture of a call option and a quantity of assets. The quantity will be denoted by

This leads us to a choice for

Note that we have glossed over the issue of what the derivative of

This technique is known as Delta-Hedging and provides us with a portfolio that is free of randomness. This is how we can apply the argument that it should grow at the risk-free rate; otherwise, as with our previous arguments, we would have an arbitrage opportunity. Hence, the growth rate of our delta-hedged portfolio must be equal to the continuously compounding risk-free rate,

If we rearrange this equation, and using shorthand notation to drop the dependence on (S,t) we arrive at the famous Black-Scholes equation for the value of our contingent claim:

Although we have derived the equation, we do not yet possess enough conditions in order to provide a unique solution. The equation is a second-order linear partial differential equation (PDE) and without boundary conditions (such as a payoff function for our contingent claim), we will not be able to solve it.

One payoff function we can use is that of a European call option struck at K. This has a payoff function at expiry, T, of:

We are now in a position to solve the Black-Scholes equation.

Reference: Deriving the Black-Scholes Equation

From https://www.quantstart.com/articles/Deriving-the-Black-Scholes-Equation/

Leave a comment :

Recent post

2025-01-10 10:12:01

2024-05-31 03:06:49

2024-05-28 03:09:25

Tagscloud

Other interesting articles

There are many other interesting articles, try selecting them from below.

2024-11-25 02:49:34

2023-11-10 10:20:40

2024-03-11 04:06:47

2024-01-17 11:24:07

2023-10-05 01:42:29

2025-04-03 01:34:39

2025-03-10 10:29:46

2024-12-04 10:28:02

2025-04-18 03:18:46