BlackRock is the world's largest asset management company currently interested in the system. Cryptocurrency It submitted an application for the creation of a Bitcoin Spot Exchang-Traded Fund (ETF) with a structure that complies with market and legal standards.

By adding Bitcoin to other investment assets, the BlackRock Bitcoin ETF offers investors an opportunity to diversify. It can also offer alternative investment vehicles that compete with Grayscale Bitcoin Trust and other cryptocurrency investment options.

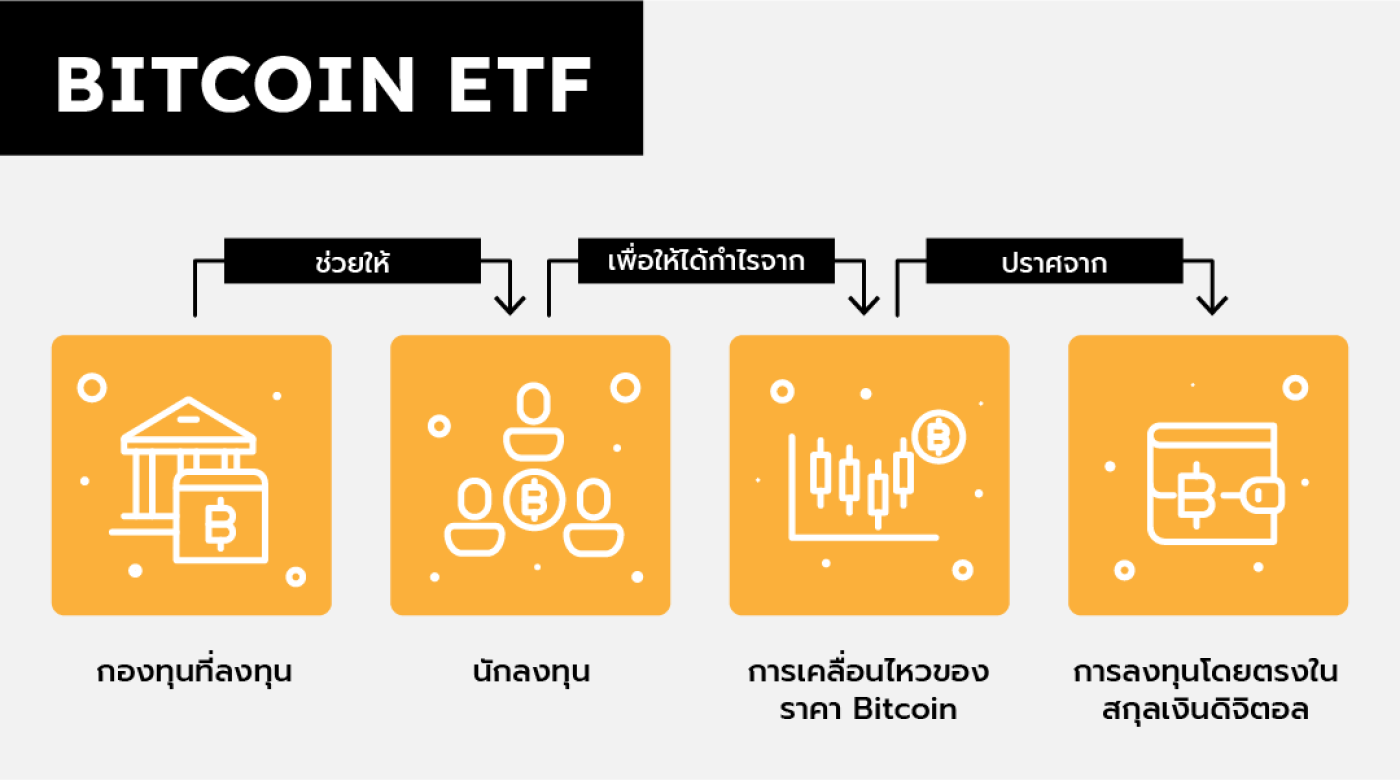

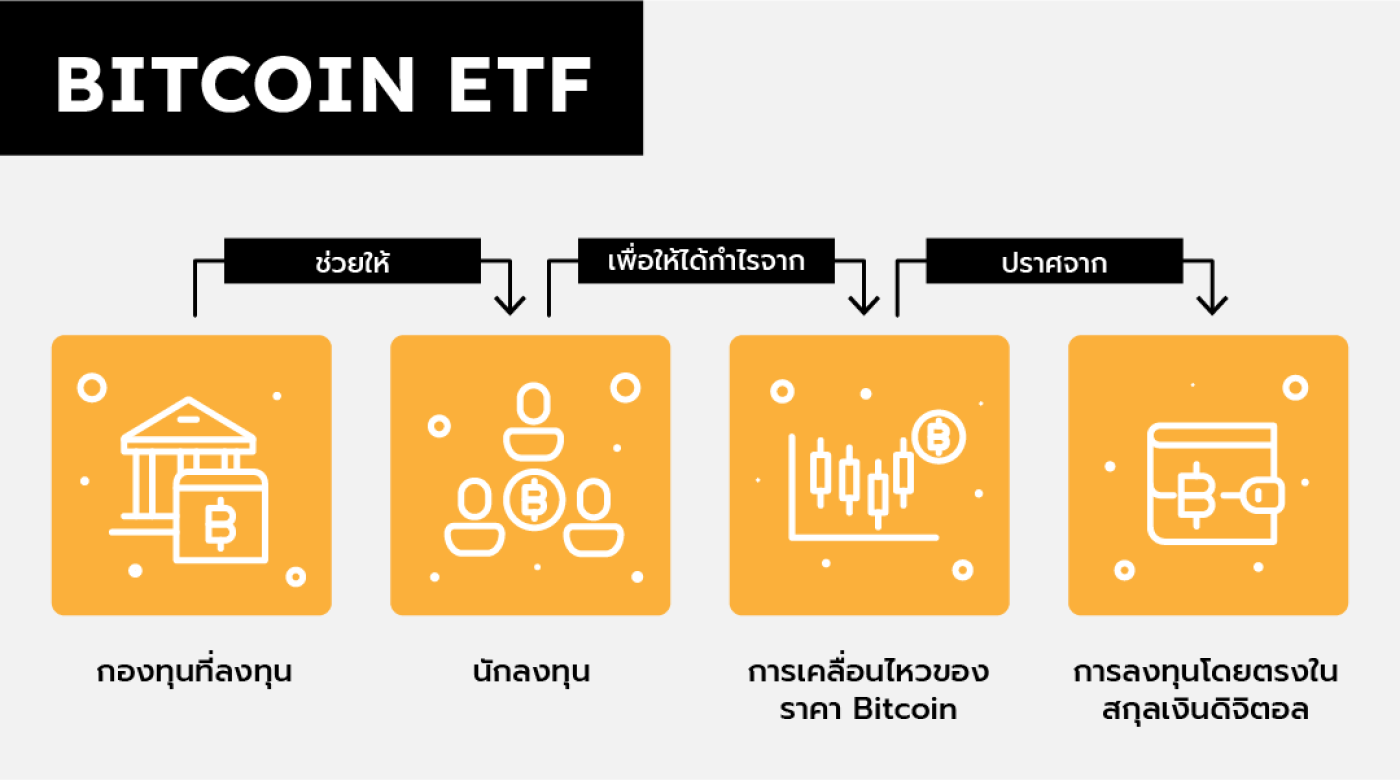

What is a Bitcoin ETF?

Bitcoin ETFs are financial products that allow investors to gain exposure to Bitcoin price movements without directly owning the cryptocurrency. Bitcoin ETFs track the performance of Bitcoin as an underlying asset.

Essentially, Bitcoin ETF investors are buying shares or units of a fund that is used as an underlying asset. ETFs are built to use Bitcoin, giving them the option to invest in Bitcoin without having to maintain and maintain a digital wallet or currency exchange. digital

strength

-Bitcoin ETF offers a regulated investment structure and can track Bitcoin price changes within the confines of financial markets. and also have access to liquidity and transparency

-Bitcoin ETF will hold a basket of more than 1 Bitcoin unit, so it has some advantages such as diversification. It also allows daily buying and selling of stocks. The same applies to securities traded on other stock exchanges.

Precautions

-Bitcoin ETFs may vary depending on jurisdiction and legal framework. Before deciding to invest Investors should carefully analyze various aspects, including fees. Tracking accuracy and ETF custodian arrangements.

BlackRock's iShares Bitcoin Trust

After BlackRock applied for Spot Bitcoin ETF on June 15 of last year, The filing coincides with a lawsuit filed by the US Securities and Exchange Commission (SEC) against Coinbase and Binance, the exchanges. Top cryptocurrency company BlackRock's iShares is seeking approval for the iShares Bitcoin Trust, a Bitcoin ETF.

The ETF intends to use the custodial service offered by cryptocurrency exchange Coinbase BlackRock. It aims to track the Bitcoin price using CME CF's Bitcoin Reference Rate, which aggregates data from trusted cryptocurrency exchanges around the world. According to official filings, CF Benchmarks, a subsidiary of Kraken, is responsible for compiling price data. In addition to considering investment potential, It is also important to evaluate the position of a spot Bitcoin ETF within the existing offerings in the US market. Grantor trusts, futures ETFs, and Bitcoin equity mutual funds are the three main types of funds available in the Bitcoin ETF market. Introducing a spot Bitcoin ETF, such as the one offered by BlackRock, creates a fourth, distinct category. Because it doesn't fit with the available options.

BlackRock's Bitcoin ETF

Bitcoin ETFs use the same features as Spot Bitcoin ETFs in that they aim to closely track the price of Bitcoin, but there are noticeable differences in their approach. First, ETFs that use this feature hold month-ahead futures contracts. The first thing that must be affected each month causes additional costs. In addition, futures contracts have an expiration date. This requires continuous management and position changes by the portfolio manager. To prevent market manipulation Futures exchanges such as the Chicago Mercantile Exchange (CME) also impose position limits on contracts. Portfolio managers of Bitcoin ETFs that use futures must purchase longer-dated futures contracts to comply with restrictions to ensure they can continue to position their funds within a regulated framework. and avoid risks from concentration

However, these variations affect the way the price of Bitcoin is tracked and can cause changes in the spot market. For example, the accuracy of a contract tracking the spot market decreases as time passes to its expiration date. Compared to current options, the Bitcoin ETF offered by BlackRock is expected to provide better price tracking and may have lower fees. BlackRock's competitors, such as ProShares Bitcoin Strategy ETF and Grayscale, charge fees of 95 basis points and 2%, respectively.

How does the BlackRock Bitcoin ETF affect cryptocurrencies?

Here's how the launch of the BlackRock Bitcoin ETF will affect cryptocurrencies:

1. Increasing acceptance of digital currencies

2. Impact on liquidity

3. Interest in regulations and investor protection

4. Market risk and volatility

5. Ripple effects on other currencies

However, investing in various funds is considered another risk that investors must study the conditions and details each time before investing.