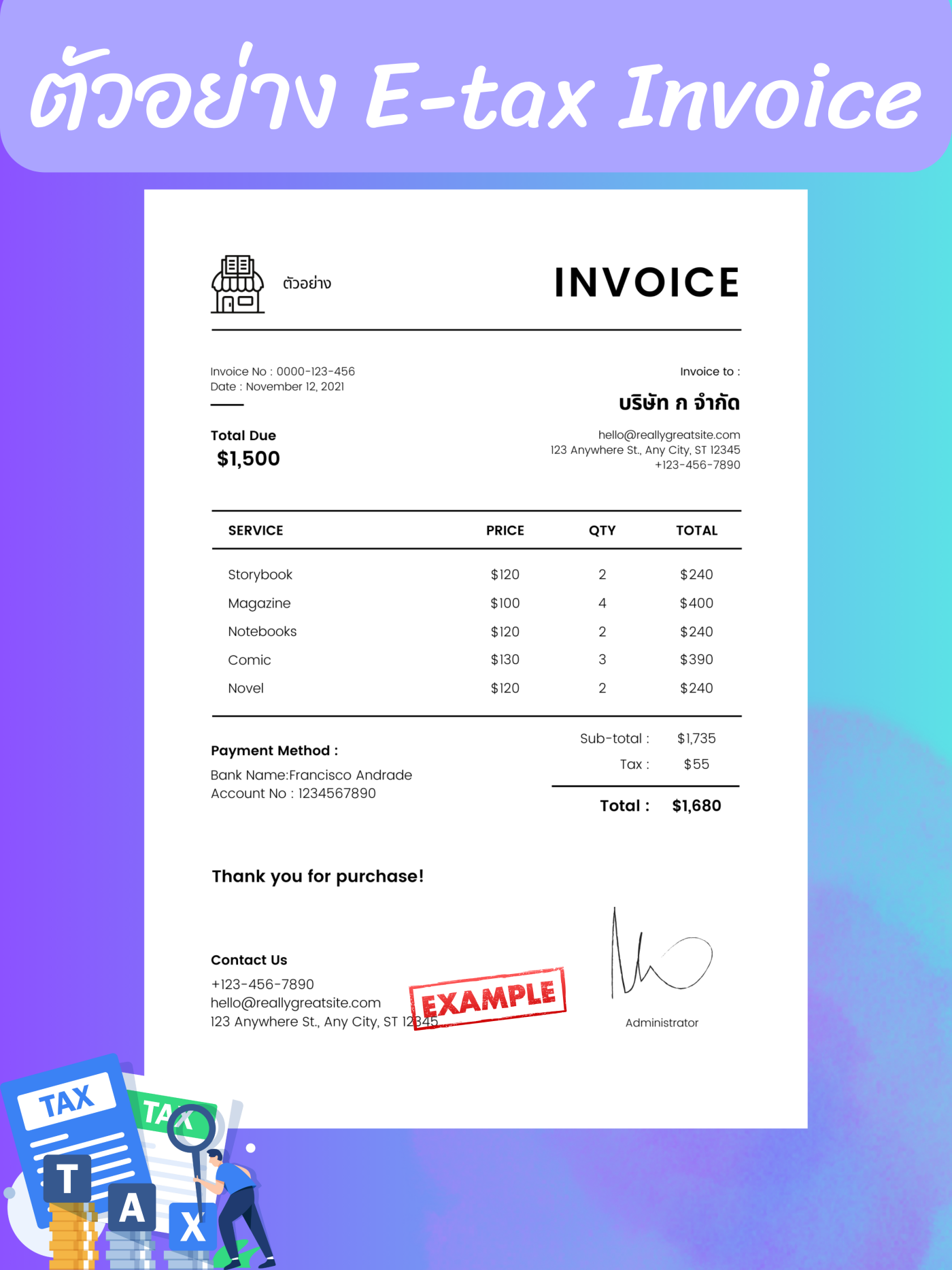

Get to know the E-Tax Invoice system, filing taxes in a new way in the digital age.

2024-06-13 05:03:06

In today's era, we are preparing documents to submit to the Revenue Department regarding taxes To support the Thailand 4.0 and National e-Payment policies in supporting electronic transactions. Increase internationalization in doing business In addition, it can reduce the cost of document management. and the amount of paper produced as well

How can you do it if you want an E-Tax Invoice?

1. Prepare and apply for E-Tax Invoice.

Study-related laws and methods for preparing document information to determine which documents are required.

- Improve the business's work system

- Register on the website of E-Tax Invoice with the document Bor.Or.1 and confirm your identity.

- Create a user account and wait for the announcement of names that have the right to create an E-Tax Invoice.

2. Document preparation

To prepare an electronic document with a digital signature, the document must be prepared as follows:

- Tax invoice (full)

- Tax invoice (short form)

- Debit note

- Debit note

- receipt (receipt)

Once the documents are prepared, they are delivered to the buyer or service provider as agreed. This can be done in 2 ways.

1.1 Do-it-yourself type

- Delivered by electronic means as agreed, such as E-mail.

- If buyers and service recipients require a paper form, please deliver the paper form.

1.2 Deliver to Service

3. Prepare information and send it to the Revenue Department as an electronic document to be delivered within the 15th of the following month. It is an XML file format or a compressed file (Zip) with an electronic signature, size not exceeding 3 MB. The documents that must be prepared include:

- Tax invoice (full)

- Debit note

- Debit note

- receipt (receipt)

It can be delivered in 3 ways: Upload XML, Host to Host, or have the Service P provider deliver it by Zip file. When unzipped, the file size must not exceed 15 MB.

4. Data preservation must be carried out by the Electronic Transactions Act 2001 by

- Use reliable methods to maintain data integrity from creation to storage where it can be retrieved again.

- Maintain information on tax invoices or receipts. It can be accessed and reused without any change in meaning.

- Preserve tax invoice or receipt information in the form it was in when it was created, sent, or received. or in a format that can display created, sent, or received messages correctly.

- Keep the part of the message indicating the origin, origin, and destination of the tax invoice or receipt. as well as the date and time of sending or receiving such message, if any.

In summary, the E-Tex Invoice system is a tax delivery system for entrepreneurs who want to transition to the digital age. And can reduce the burden of storing paper documents as well.

Leave a comment :

Recent post

2025-01-10 10:12:01

2024-05-31 03:06:49

2024-05-28 03:09:25

Tagscloud

Other interesting articles

There are many other interesting articles, try selecting them from below.

2025-01-10 04:00:42

2024-11-25 03:28:23

2024-04-19 03:03:34

2023-09-20 02:39:12

2023-11-15 10:19:13

2024-10-28 04:22:55

2025-05-05 09:39:07

2025-04-01 02:06:08